Inventory – Part 1: How To Run A Profitable Bike Shop

Every retailer needs inventory. Very few have the right amount or even the right mix. Why is it so hard to get this essential parameter of a successful business. There are a few reasons that come to mind in my experience. The biggest seems to be fear of lost sales and the need to have something for everyone’s mentality. Second is the requirements of vendors and the lure of long dating, creating a feeling that you can move that product before the bills come due – which, based on how many retailers seem to miss payments, happens far less than hoped. Let’s face it, bicycle retailers are typically cyclists, and all that fresh inventory is fun! And along those same lines, there can sometimes be some ego involved in carrying certain types of bikes at specific price points that make for some poor decisions. It is hard to admit that your store may not be capable of selling a particular category or price point of bikes – at least profitably. This inability usually leads to discounting and enormous amounts of time spent on unprofitable areas of the business to satisfy the need to create or maintain a particular appearance. Want to know one of the secrets of a profitable bike shop? Look at their inventory. They will have the right amount in the correct categories.

The Right Amount

So how do you unravel the seemingly deep dark mysteries of how much inventory is correct? It is effortless. You want to have an amount that allows you to turn that inventory multiple times. Based on my own experience and that of retailers I admire and having seen the financials of shops performing both well and abysmally, there are some dead giveaways. Our industry loves the idea of two turns, yet many shops do not even get to that point. I believe that somewhere around 3-3.5 should be most stores’ target goal. Some stores are a bit higher and some a touch lower. But at the end of the day, that’s a realistic number to make your aim.

The Math

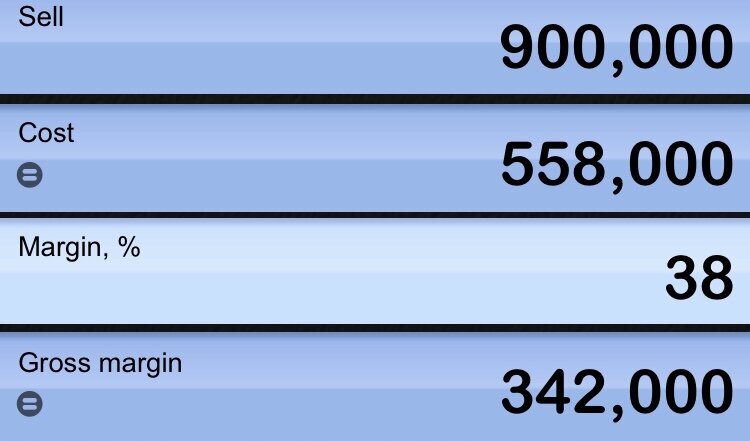

So how do you arrive at that number? Here is where being very careful is essential. I have spoken to some retailers who have been at it for a while, pay their bills on time, and seem to know their stuff end up stumbling here. First, we need to arrive at your gross sales. Most retailers do not enter a cost amount to labor items, which I believe is the correct way. Your costs for labor are an expense and are already accounted for as such. That means labor should be removed from your gross sales. I like to use 1 million dollars as a round number for gross sales in examples like this, and it is pretty much agreed that this is what the “average” store does annually. Let us also assume that labor dollars account for 10% of gross sales. This amount needs to be removed from the equation. You and I are on the same page, which means that we now are at $900,000 in gross sales that need inventory to produce that amount. The last assumption is that the sales of that inventoried product return a 38% margin, which is sadly often high. If you know your gross margin (you should!) use that, otherwise use 38% with your numbers as it is a unique generalized number when labor is removed. If you are higher, it will net you an amount that would give you more turns – which is a good thing. I like an app called iMargin, which is free. Those numbers will look like this:

“COST EQUALS YOUR NEEDED INVENTORY AMOUNT FOR THE YEAR – DIVIDE BY NUMBER OF TURNS DESIRED.”

Now all you have to do is divide “cost” by three, which equals $186,000 at three turns, $159,428 at 3.5, and so on. Retailers are achieving 4-5 turns and some less than one.

Plugin your numbers and see where you are. Chances are you are probably carrying a little too much inventory. If you are taking a lot more than advised, you are perhaps struggling with cash flow issues. This topic is one of the first key performance indicators I dig into with a consulting client.

In part two of the inventory section of this series, we will dig deeper into the fine-tuning of that 3-3.5 turns dollar amount and discuss how to get much more granular with that one significant number. If this all seems pretty basic, that is a good thing! If this is a little confusing (or a lot), pay attention closely, as this is critical to your success, which is another word for profitability!

Please reach out to me if you would like to discuss this further at david@nbda.com or check out the P2 Consult NBDA program!

Words by David DeKeyser

David DeKeyser and his wife Rebecca Cleveland owned and operated The Bike Hub in De Pere, Wisconsin, for nearly 18 years. In 2018, they sold the business and real estate to another retailer based in a nearby community. David now writes the Positive Spin series on Bicycle Retailer and Industry News and he writes articles for the NBDA’s blog, Outspokin’. David also provides business consulting through the NBDA’s P2 Consult Program.

David DeKeyser and his wife Rebecca Cleveland owned and operated The Bike Hub in De Pere, Wisconsin, for nearly 18 years. In 2018, they sold the business and real estate to another retailer based in a nearby community. David now writes the Positive Spin series on Bicycle Retailer and Industry News and he writes articles for the NBDA’s blog, Outspokin’. David also provides business consulting through the NBDA’s P2 Consult Program.

The NBDA has been here since 1946, representing and empowering specialty bicycle dealers in the United States through education, communications, research, advocacy, member discount programs, and promotional opportunities. As shops are facing never-before-seen circumstances, these resources offer a lifeline. Together, we will weather this. We at the NBDA will not waver in our commitment to serving our members even during this challenging time—but we need your support.

The NBDA has been here since 1946, representing and empowering specialty bicycle dealers in the United States through education, communications, research, advocacy, member discount programs, and promotional opportunities. As shops are facing never-before-seen circumstances, these resources offer a lifeline. Together, we will weather this. We at the NBDA will not waver in our commitment to serving our members even during this challenging time—but we need your support.

Now is the time to become a member as we join together to make one another stronger. Whether you’re a retailer or an industry partner, your membership in the NBDA is one of the best investments you’ll make this year.

Learn more about the benefits of being a member and join now.